Housing costs are the greatest expense and share of household budgets for adults age 55+, according to the Consumer Expenditure Survey. Prior to the COVID-19 pandemic, nearly 10 million older adults were having trouble paying for housing.1 Today, skyrocketing inflation and rents mean those numbers are likely much higher.

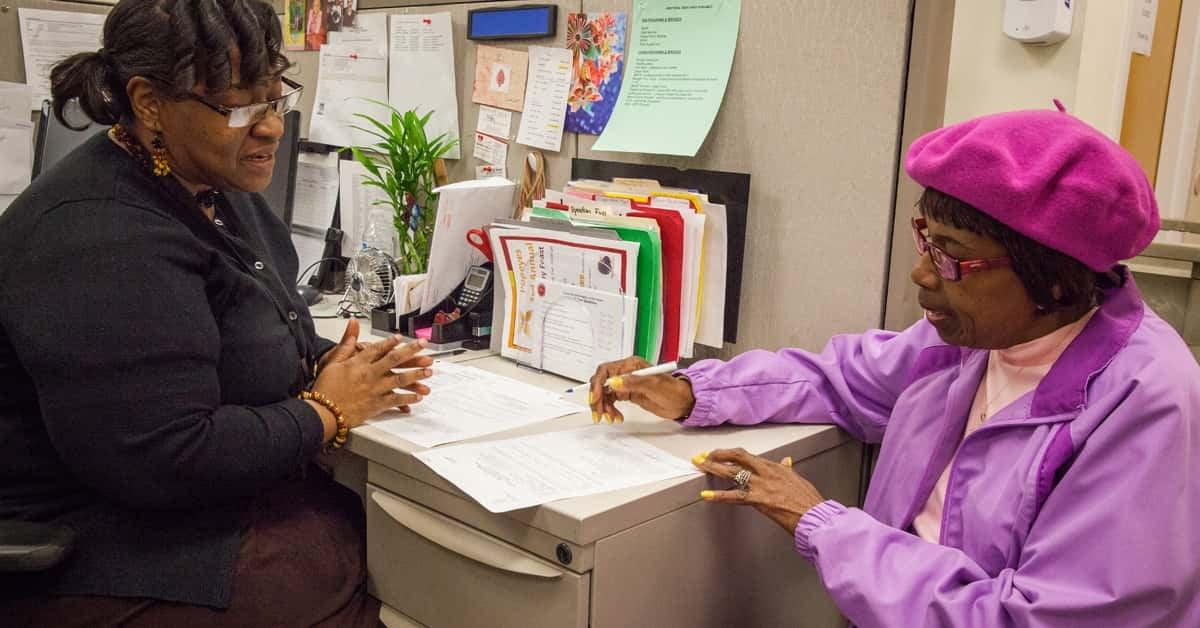

Whether you’re a homeowner or a renter struggling to afford your housing, there are resources that may help.

The HOPE™ Hotline: 1-888-995-HOPE (4673)

995HOPE offers free renter counseling and education to support people in addressing their housing concerns. Professional, caring counselors will work with you to assess your situation, explain the options or solutions available, and help you create a detailed action plan. You will get referrals to local, statewide, and national resources. The HOPE Hotline does not directly administer rental assistance programs or offer financial support to renters.

The HOPE Hotline is administered by the Homeownership Preservation Foundation and its affiliate, GreenPath, which are trusted, national nonprofits dedicated to guiding consumers onto the path of sustainable homeownership and improving their overall financial health. Learn more at https://995hope.org/ or call 1-888-995-4673.

Where to find state and county rental assistance programs

In response to the dire financial impact of the COVID-19 pandemic, the government provided funded to states for emergency rental assistance programs to assist those who may have fallen on hard times. While the majority of these temporary programs are not longer accepting applications, there still may be rental assistance available in your community.

Visit this Consumer Financial Protection Bureau page to find rental assistance programs and help with other bills such as utilities.

Can older adults get public housing and housing vouchers?

Public housing provides eligible low-income families, including older adults and adults with disabilities, a place to call home and ranges from scattered single-family houses to high rise apartments. Housing vouchers (sometimes referred to as Section 8) can help you afford a rental that is not limited to specific housing units.

Find your local housing authority to see if you qualify for public housing or a housing voucher. The U.S. Department of Housing and Urban Development (HUD) also has a search tool you can use to find an apartment or home with reduced rent in your area and landlords who accept Section 8 housing vouchers.

Should you tap into your home equity?

If you’re an older homeowner, you may be able to tap into your home equity to afford to keep living in your home. Home equity is the difference between what your home’s value is and what you may still owe on a mortgage, if you have one.

A home equity line of credit works like a credit card. You can borrow up to a certain limit for a set period of time, such as 10 to 15 years. During that time, you can withdraw money as needed, and may be able to pay only the interest on the balance. Once the time is up, you must pay back both principal and interest within a repayment period, such as 10 years, making the monthly payments much higher. Costs to set up these loans may be relatively low.

Similarly, a home equity loan lets you take out the money in a lump sum. Then you must pay it back over a set amount of time, with fixed monthly payments that include both principal and interest.

Our publication, Use Your Home to Stay At Home, lists some of the pros and cons of taking out a home equity line of credit or home equity loan.

Is a reverse mortgage good for older adults?

If you own your home outright, or have only a small mortgage left, you might consider a reverse mortgage. This is a unique type of loan for homeowners age 62 and older. A reverse mortgage lets you convert a portion of the equity in your home into cash without having to sell your home or make additional monthly payments. But unlike a home equity loan, you don’t have to repay the reverse mortgage loan until you either no longer use the home as your primary residence—or you fail to meet the loan obligations.

A reverse mortgage is not right for everyone. You may want to consider a reverse mortgage if your home is steadily increasing in value and you plan to live there for many more years. It's important to note that reverse mortgages are not the best way to get cash in an emergency. You should not consider a reverse mortgage if you:

- need immediate financial help

- cannot afford your property taxes or upkeep on your home

- wish to leave your home to a spouse or heirs

How can home sharing help older adults afford housing?

Home sharing is a way for older adults who own a home to bring in some extra money and for those looking for an affordable place to live to find a roommate.

If you own a residence with a spare bedroom or unit (such as a basement apartment), you might consider renting it through a home share arrangement.

If you’re interested in home sharing, you may want to work with a reputable company to make it easier to find a roommate. Companies such as Silvernest and Senior Homeshares provide help with background screening, creating a lease, and matching roommates.

Find other resources to ease your housing budget

If you struggle to find affordable housing, you may want to explore other benefits that can free up income that you can put toward rent or mortgage payments. Thousands of public and private programs are available to help low-income older adults pay for home heating and cooling, health care, prescriptions, food, and other expenses.

NCOA’s BenefitsCheckup is a confidential benefits screening tool that can help you see if you qualify for these programs. Just visit BenefitsCheckup.org and enter your ZIP code to get started.

Sources

1. Housing America's Older Adults 2018. Joint Center for Housing Studies of Harvard University. Found on the internet at https://www.jchs.harvard.edu/housing-americas-older-adults-2018