Reviewing the Best Online Will Makers: Our Recommendations for 2026

We tested online will makers to find the ones that make the process fast and straightforward. Our top pick for the best online will maker is LegalZoom.

- LegalZoom is our pick for Best Overall online will maker.

- Starting costs for online wills range from $50–$150.

- Most online will makers offer attorney access for an extra fee.

- Online wills are an affordable and accessible option for creating important documents as part of your overall estate planning.

NCOA connects older adults and their families with trusted tools and resources that support health, independence, and peace of mind. When it comes to estate planning, that means carefully vetting the services we recommend, so you can feel confident about making important legal decisions online.

We spent more than 200 hours researching and evaluating online estate planning platforms before making our recommendations. We:

- Consulted with estate planning attorneys, financial advisors, and care providers

- Created accounts and completed real estate planning documents using each platform’s tools

- Evaluated ease of use, document accuracy, customization options, and security protocols

- Reviewed thousands of verified customer ratings to understand satisfaction, support, and usability trends

Our testing is ongoing. And we continue to monitor new features, updated policies, and platform improvements so our recommendations remain current and relevant. Read more about our estate planning testing methodology.

When getting ready to put your estate plan together, one of the most important steps is making a will or trust. For decades, this meant spending money and time on meeting with a lawyer. These days, it’s possible to create a legally binding will through various websites. Some of these sites make the process quick and straightforward, while others handle complex trusts and estates. The best online will makers streamline a complicated process into one that’s much more accessible and affordable.

Who are our testers?

To make sure the platforms are easy to use—and also comprehensive from a legal standpoint—our testers were adults who had never made a will before, and an estate planning attorney.

We tested online will and trust makers for their ease of use, customer friendliness, and access to legal assistance. In this guide to the best online will maker, we highlight the value of each of our top picks. We also explain which ones are best suited for different goals and outline how to find the right one for you.

- Low starting costs

- 60-day refund window

- Direct attorney assistance (add-on)

- Easier, guided process

- Most user-friendly online will maker we tested

- Helpful pop-ups and recommendations guide you

- Transparent and robust data protection

- Unlimited updates for a low yearly fee ($19)

- Make a will, trust, and directives for health care, finances, final wishes, and pets for one price

- Includes a Family Plan with unlimited updates for 5

- Digital Vault included

Our picks for the best online will and trust makers:

- LegalZoom: Best Overall

- Trust & Will: Easiest to Use

- GoodTrust: Best for All-in-One Services

- Nolo: Best Value

- Rocket Lawyer: Best for Legal Advice Access

Comparing the best online will makers of 2026

| Comparison Features | |||||

|---|---|---|---|---|---|

| Our rating (out of 10) | 9.9 |

9.7 |

9.5 |

9.7 |

9.8 |

| Free access to attorney | No, costs $20/month |

No, costs $299 |

No |

No |

No, costs $20/month |

| Free wills for multiple family members | Yes |

Yes |

Yes |

Yes |

No |

| Living will form | Yes |

Yes |

Yes |

Yes |

Yes |

| Durable power of attorney form | Yes |

Yes |

Yes |

Yes |

Yes |

| Available in all 50 states (+DC) | Yes |

Yes |

Yes |

No |

Yes |

"Whether you have a little or a lot, your estate represents your life’s work. Estate planning is for everyone—because everyone deserves to be heard, protected, and remembered well.”

—Rusty Fracassa, attorney at Paths Law Firm in Lee’s Summit, Missouri

Our reviews of the top online will makers

LegalZoom: Best Overall Online Will Maker

We chose LegalZoom as the Best Online Will Maker Overall because of its low starting costs (the lowest on this list), wide range of add-on assistance options, and user-friendly processes. We like that LegalZoom includes its pricing upfront. Some online will makers require you to draft the will first before telling you how much it’s going to cost—not LegalZoom. After testing it ourselves, we think LegalZoom’s variety of offerings can provide value to most people looking to create a will.

- Learn more in our LegalZoom review

- Low starting costs

- 60-day refund window

- Direct attorney assistance (extra $20/month, includes unlimited 30-minute attorney consultations for 30 days)

- Document storage: Yes

- Access to an attorney: Yes

- Unlimited updates: Yes, for one year

- Satisfaction guarantee: Yes

Why we chose LegalZoom as Best Overall

We chose LegalZoom as Best Overall Online Will Maker because we think its large range of offerings and low starting costs make it an accessible option for most people looking to create their will online. LegalZoom’s pricing is upfront, and it has the second-lowest starting cost on this list (after Rocket Lawyer, which is free for the first seven days). We also appreciate how user-friendly LegalZoom is and the way it walks you through the process.

LegalZoom pros and cons

Pros

- Wide range of offerings

- Straightforward process

- Low starting costs

- Accepted in all 50 states

Cons

- You must pay extra for attorney assistance

- No combo plan for will and trust

Our testing experience with LegalZoom

When we tested LegalZoom, the first thing our testers noticed was how straightforward the pricing options were. Some online will makers, like Rocket Lawyer, don’t give you pricing upfront. You need to create your document first. But LegalZoom allows you to select the package you’d like first and outlines what each includes, so you don’t have to worry about hidden prices or fees. “Once I paid I just created an account and started the form filling process,” one tester said. “The process was very straightforward and had a ‘start to finish’ feel.”

Altogether, it took our testers about 40 minutes to finish drafting their wills with LegalZoom. It’s worth noting that this is the longest it took our testers. The average was 23 minutes. Despite it taking the longest, testers still said it was “quick and easy.”

We like that LegalZoom prompts you with questions as you go and fills in the forms based on your answers. This makes the process simpler and user-friendly. For someone who might be anxious about creating a legal document online, this process can ease those fears. “I think the website was very intuitive and people of all ages should be able to use this service and walk through step by step to fill out their information,” one tester said.

LegalZoom also gives the option to purchase direct attorney assistance as an add-on, starting at an extra $20 per month. Choosing this means an attorney will review your final documents. You also receive unlimited 30-minute calls with an attorney each month. This benefit applies to your spouse and any dependent children. It’s a great option for people who might have general legal questions as they navigate estate planning. We do wish this benefit were included in the basic plan, though.

You can learn more in our LegalZoom will and trust services review.

The LegalZoom customer experience

- Warranty and trial period: 60-day satisfaction guarantee

- Customer service:

- Phone: 866-679-1568, Monday through Friday from 5 a.m. to 7 p.m. PT, and Saturday through Sunday from 7 a.m. to 4 p.m. PT

- Chat: Available on the website

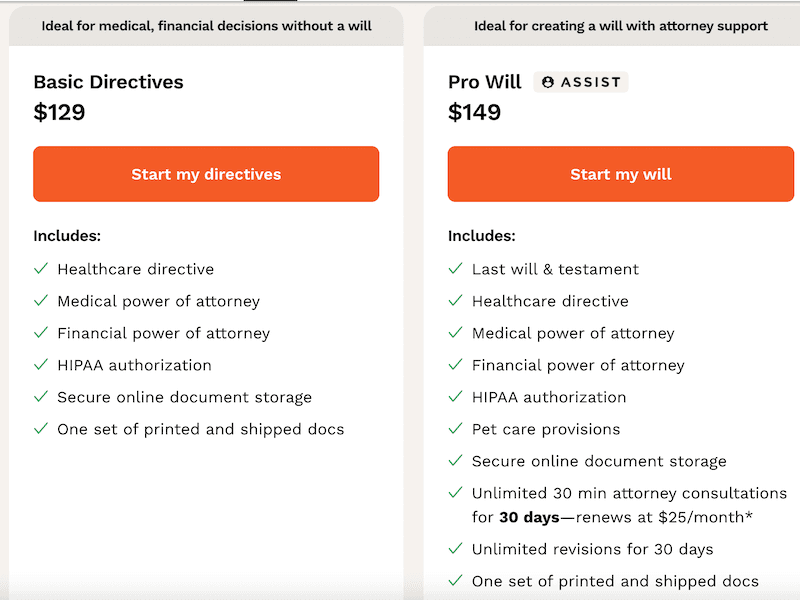

Trust & Will: Easiest Online Will Maker to Use

We like Trust & Will because it offers helpful AI-powered recommendations and detailed pop-ups that guide you through the will-making process. These features make it a good choice for those new to making wills or who feel nervous about doing it correctly. Most online will makers we tested didn’t provide such in-depth explanations and guidance. “Trust and Will was the best experience out of all the services I tried,” one tester said. “Their user experience was the most intuitive and clean.”

- AI-powered pop-ups help explain the process

- Unlimited updates

- Ability to share a draft for feedback

- Document storage: Yes

- Access to an attorney: Yes, (starts at $299 extra)

- Unlimited updates: Yes ($19/year)

- Satisfaction guarantee: Yes

Why we chose Trust & Will as the Easiest to Use

We chose Trust & Will as the Easiest to Use Online Will Maker because the program includes helpful explanatory pop-ups and recommendations that keep the will-making process transparent. Trust & Will is a user-friendly option for people new to creating wills or who may feel nervous about drafting legal documents on their own. Trust & Will lets you make unlimited updates to your documents (for $19/year), so people new to the process can feel comfortable making revisions.

We appreciated that Trust & Will outlines its extensive security features on its website, including HIPAA certification and data encryption. According to our testers, Trust & Will was the most transparent with this information and provided the clearest explanations about why it matters. “Trust & Will had the most extensive list of their security provisions out of all the services,” one tester said. “This made me feel the safest out of all of the services, and I liked how they took the time to explain each one and why it is important. I love their attention to detail.”

Trust & Will makes the process of getting your documents simple, too. The documents are ready quickly, and you have the option to receive them digitally or have them shared. Unlike about half of the online will makers we tested, Trust & Will offers digital storage of your documents (included in plan cost). We like this option for those who aren’t comfortable organizing and storing their own important documents. For an additional $19 per year, you can make unlimited updates to your will. That’s less than half the cost of unlimited updates with other online will makers, like LegalZoom.

Trust & Will pros and cons

Pros

- User-friendly interface that includes explanatory pop-ups, videos, and AI-powered recommendations

- Unlimited updates for a yearly fee ($19), half the price of competitors

- Ability to share drafts with others

- Robust security features

Cons

- Attorney assistance is an additional fee ($299 for one year of unlimited 30-minute consultation calls)

- No will and trust combo available

Our testing experience with Trust & Will

When we tested Trust & Will, we were impressed by how user-friendly the process was. “This site was the most thorough with assistance and giving instructions before starting,” one tester said. “They had a video to watch, and each section felt like there was very well-written instruction.”

We also appreciated that there were opportunities to click on pop-ups for help if we had questions about a section. “If you were unsure of something, it had a question mark you could click on and it would give a description and examples,” one tester said. “The site is very intuitive and the design is well organized.”

This built-in support makes Trust & Will a great option if you’re nervous about making a legal document online. You might feel more reassured by the information provided by the pop-ups.

While you can purchase additional attorney support through Trust & Will, it is more expensive (an extra $299 a year compared with LegalZoom’s starting cost of $20 a month for attorney assistance). And the attorney support isn’t available in all 50 states, so you’ll want to double-check if your location qualifies before spending any money. Unlike LegalZoom, the attorney assistance is only for will and trust questions.

Trust & Will estate planning documents

Trust & Will offers estate planning services, including wills and living trusts. Deciding which type of document is right for you depends on your budget, the size and complexity of your estate, and whether you have multiple properties or inheritors.2 Typically, someone with a smaller estate or adult inheritors would benefit from a will. If you have a complex estate or minor children, or you want to create an inheritance plan over multiple years, you’d choose a trust.2

Trust & Will offers both individual and couple will or trust plans. They also offer a young adult plan for people ages 18–26.

For more information on estate planning, see our estate planning checklist.

The Trust & Will customer experience

- Warranty and trial period: 30-day satisfaction guarantee

- Customer service:

- Email: support@trustandwill.com

- Live Chat: Available on the website Monday through Friday from 7 a.m. to 5 p.m. PT on their website

- Submit a request using an online form

GoodTrust: Best Online Will Maker for All-in-One Services

We chose GoodTrust as Best Online Will Maker for All-In-One Services because you can create a will, trust, and advance directive for one fee. Most services, such as LegalZoom and Trust & Will, don’t allow you to bundle these documents and charge you separately for each. If you need multiple documents, GoodTrust allows you to create them all for a single, flat fee.

- Make a will, trust and directives for health care, finances, final wishes and pets for one price

- Includes a Family Plan with unlimited updates for 5

- Digital Vault included

- Document storage: Yes

- Access to an attorney: No

- Unlimited updates: Yes

- Satisfaction guarantee: 20-day refund policy, no questions asked

Why we chose GoodTrust as Best for All-in-One Services

We chose GoodTrust as the Best Online Will Maker for All-in-One Services because it allows you to make a will, a trust, and an advance directive for one fee. If you need multiple estate planning documents, GoodTrust helps to keep things simple and affordable.

GoodTrust pros and cons

Pros

- All-in-one package for a single fee

- Includes a pet directive

- Unlimited wills for family members

- Unlimited revisions

Cons

- No attorney access

- Form options are less robust than other will makers

Our testing experience with GoodTrust

When we tested GoodTrust, the first thing we noticed was that the process feels different from other online will makers, such as LegalZoom. “Usually, the site guides you to a form; you fill out that form in its entirety, and then you are done,” one tester said. “With GoodTrust, they break each part of a will or your estate into different forms or checklists to complete.”

Our testers thought this type of website was a nice change from the others, which typically have you completely fill out a form. “I like this type of interface in a lot of ways because you can fill it out in little bite-sized sections,” one tester said. This can be a good option for someone who feels overwhelmed by the process.

Plus, it’s more affordable and convenient to have a will, trust, advance directive, and even a pet directive, all included for one price. Other websites require you to purchase each document individually, which can become expensive. Instead, GoodTrust gives you access to all forms at once. It also includes unlimited revisions and the option to make wills for up to five other adult family members at no extra cost. The starting cost for a GoodTrust will, trust, and pet directive is $149. Those same three documents, purchased separately from LegalZoom, would cost $528.

Testers were impressed with how quickly the forms could be filled out—one tester completed their documents in six minutes. But some testers were worried that GoodTrust sacrificed details for speed. They found the forms weren’t as in-depth as other online trust and will makers. And GoodTrust doesn’t offer attorney access, which could be a drawback if you want legal advice.

GoodTrust also offers a unique Digital Vault service. It allows you to organize, store, and share your most important documents. You can share documents from your Digital Vault with anyone you choose, and you can set it up so those documents are only shared if something happens to you.

The GoodTrust customer experience

- Warranty and trial period: 20-day refund policy, no questions asked

- Customer service:

- Submit a ticket on the GoodTrust website

- Chat: Available on the website

Nolo: Best Value Online Will Maker

We chose Nolo as the Best Value Online Will Maker because it provides access to a wide range of documents and features, along with a 30-day money-back guarantee. We think Nolo gives you the most estate planning tools for the price.

- Software product you access from your computer

- Unlimited updates

- Interview-like process to easily fill documents at your own pace

- Document storage: Yes

- Access to an attorney: No

- Unlimited updates: Yes

- Satisfaction guarantee: Yes

Why we chose Nolo as Best Value

We chose Nolo as the Best Value Online Will Maker because its comprehensive forms and user-friendly interface make this option a great choice for someone looking to maximize their purchase. We also like that Nolo is a SaaS (Software as a Service) product rather than a website you log into. That means you can use Nolo on your computer at your own pace without having to remember a profile password.

Nolo pros and cons

Pros

- SaaS product means Nolo is convenient and accessible

- Unlimited updates

- Create wills for multiple family members

Cons

- No digital storage options

- Not as explanatory or supportive as other options

Our testing experience with Nolo

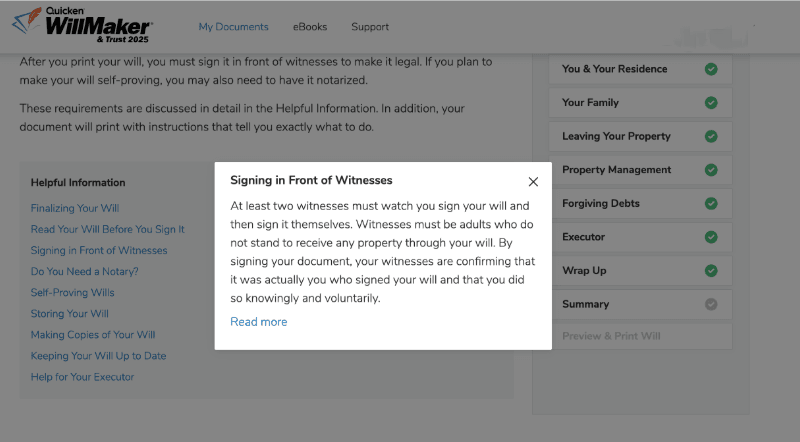

When we tested Nolo, some of our testers found the SaaS aspect to be a little confusing. Nolo is provided through Quicken, so when you download the software, you’ll see Quicken’s name connected to it. “When I first signed on, it took me from Nolo to Quicken,” one tester said. “That was a little confusing at first.”

Once downloaded, Nolo guides you through filling out the various forms by asking relevant questions.

Our testers found the process of creating a will straightforward. “I didn’t need any documents to start the process,” one tester said. “It gave a thorough checklist of the process and walked me through section by section, filling it out. It was easy.”

And once done, you have the option to purchase attorney support. “It was quick and only took me roughly 20 minutes,” one tester said. “They also did offer an attorney to review it at the end, which I thought was nice. They offered a service to connect you with one if need be.”

While some testers appreciated the streamlined process, others were dissatisfied with the limited support available. “Overall, I felt like this software would get the job done for simple estate planning,” one tester said, “but I felt a little confused in sections whether I was filling out the right information.” For someone who wants more clarification as they go, Trust & Will might be a better option.

The Nolo customer experience

- Warranty and trial period: 30 days

- Customer service:

- Phone: 800-728-3555, available Monday through Friday from 8 a.m. to 5 p.m. PT

- Email: techsupport@nolo.com

- Chat: Available on the website

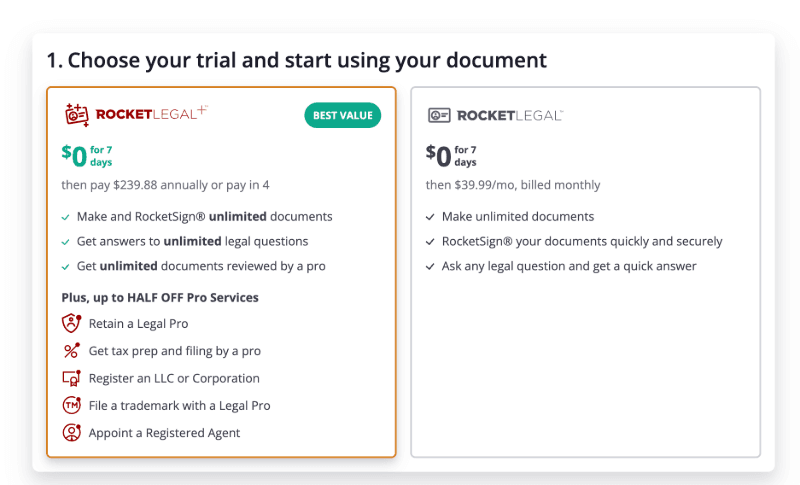

Rocket Lawyer: Best Online Will Maker for Attorney Access

We chose Rocket Lawyer as the Best Online Will Maker for Attorney Access because you can purchase a monthly subscription that gives you access to attorneys across a wide range of legal fields, from business to family law. It’s also free to make a will during the initial seven-day free trial period.

- Free will template

- Access to a wide range of attorney assistance

- Free seven-day trial

- Document storage: No

- Access to an attorney: Yes, for a fee ($20/month)

- Unlimited updates: Yes

- Satisfaction guarantee: No

Why we chose Rocket Lawyer as Best for Attorney Access

We chose Rocket Lawyer as the Best Online Will Maker for Attorney Access because it offers comprehensive legal assistance for a monthly membership fee —a unique feature. While companies like LegalZoom offer general attorney advice, Rocket Lawyer uses legal professionals who handle a broader range of topics, including divorce, custody, and business matters. If you have a complex estate or want legal support in other areas of your life, Rocket Lawyer can be a good choice.

Rocket Lawyer pros and cons

Pros

- Comprehensive attorney support

- Free will template

- Free seven-day trial

Cons

- Free template is somewhat limited

- Website is confusing to navigate

Our testing experience with Rocket Lawyer

When we tested Rocket Lawyer, our testers found it a bit challenging to locate the correct form on the website. That’s because Rocket Lawyer is one of the most comprehensive online trust and will makers—it handles much more than just estate planning. “The process was a little confusing. Rocket Lawyer offers lots of products, so I had to do some searching,” one tester said.

Once they located the “Last Will and Testament” document, though, they found the actual process of filling out the form to be quick and simple. “I do love how you can take notes along the process to ask an attorney. That way you don't forget what your questions are about,” one tester said. “They also do a really great job of explaining each section. The questions seemed very thorough.”

The form is a downloadable template you can fill out for free. If you need help, you have the option to contact an attorney at the end. You can do this as part of the seven-day trial or purchase a membership that provides comprehensive access for a year. If you are someone who needs extra guidance, Rocket Lawyer is a more affordable option than paying different lawyers an hourly fee every time you need help.

Due to the limitations of the template, we believe Rocket Lawyer is a good option if you are already working with a lawyer or plan to in the future. “It’s a good first step to organize your thoughts and then take that to an attorney to review,” one tester said. “It also helps prompt you to figure out your needs and wishes.”

For someone new to making legal documents, Rocket Lawyer’s user interface might seem confusing. And if you need more than just a will as part of planning your estate, you’ll want to explore other options, such as GoodTrust or LegalZoom.

The Rocket Lawyer customer experience

- Warranty and trial period: Seven-day free trial

- Customer service:

- Phone: 877-881-0947, available Monday through Friday from 6 a.m. to 6 p.m. PT

- Email: Through a form on the website

- Chat: Available on the website

What to look for when choosing an online will maker

In our 2025 Estate Planning Survey, 86% of respondents said they chose an online will maker because it’s affordable and convenient.1 When choosing an online will maker, you should consider the following features to help you decide which one is right for you:

Last will and testament

A last will and testament is the most basic form you need to ensure your assets don’t get tied up in probate court (the legal entity that oversees the process of administering the estate of a dead person). Any legitimate service will offer you the option of a last will and testament.

“Without a will, state law decides who inherits your assets—and that may not reflect what you would have wanted,” said Rusty Fracassa, the founder and principal attorney at Paths Law Firm in Lee’s Summit, Missouri. “A will allows you to say clearly who should receive your property, who should manage your estate, and, if needed, who should care for any minor children.”

Additional estate planning documents

Consider a company that offers extra documents like pet directives, advanced directives, trusts, power of attorney, and whatever else might apply to your specific situation.

Document storage

If you have important documents you’d like to store along with your estate documents, look for a company that includes virtual storage.

Access to an attorney

Access to an attorney is an important feature if you have questions, need help, or feel unsure about creating a will. You can look for something as simple as an attorney review once you’re done with your documents, or more comprehensive support in the future.

Some people don’t feel like it’s necessary to work with an attorney. "While working directly with a locally licensed estate planning attorney is always recommended for those who can, platforms like LegalZoom and Trust & Will provide a cost-effective alternative for people who may not have access to traditional legal services,” said Andrew Rowe, an estate planning attorney in Wichita, Kansas. “For users with limited budgets, this form of legal support can be a valuable and practical resource.”

You can read more in our guide about how to make a will without a lawyer.

Unlimited updates

Your situation may change as you get older. Over time, your will may become more complex or you may need to update your beneficiaries. If you think you might need to change your will or trust, look for a company that offers unlimited updates.

Free trial

A free trial or refund window can help make it easier to take a chance on a specific product, because you’ll be able to get a refund if it doesn’t work out. Look into each company’s specific incentives and refund policies.

What is a will?

A will is a legally binding document that outlines how to distribute your property and assets after your death. A will can be used to name guardians for any surviving children, pets, or other dependents.

What is a living will?

A living will, also known as an advanced directive, describes what type of medical care or services you’d like in the case that you can’t make your own decisions. Living wills can include things like DNR (do not resuscitate) guidance, pain management, and organ donation.

What is a will vs. a trust?

A will is a document that goes into effect after you’ve died. A trust, on the other hand, can go into effect while you’re still alive and continue after your death. Trusts are designed to distribute specific assets, such as inheritance money to children, on a specified schedule. A third party typically manages trusts.

Is an online will a good idea?

Yes, an online will is a good idea for many people. If you don’t have the time or money to sit down with a lawyer, or you have a simple estate, an online will can be an accessible and affordable way to ensure that your assets transfer to your living beneficiaries. In almost all cases, a will is better than no will at all, and online wills make it easier to protect your legacy.

Is my information secure?

Yes, the companies highlighted in this article all have encrypted and secure methods for keeping your sensitive information safe. Like all online profiles, it’s important to keep your username and password protected. Don’t fill out an online will on a public or shared computer.

Comparing features of the best online will makers

| Comparison Features | |||||

|---|---|---|---|---|---|

| Starting cost | $129 |

$150 |

$149 |

$109 |

Free* |

| Satisfaction guarantee** | Yes |

Yes |

Yes |

No |

No |

| Free unlimited updates | Yes |

Yes |

Yes |

Yes |

Yes |

| Document storage | Yes |

Yes |

Yes |

No |

No |

*A state-specific will template is free, though limited

**If your order has been completed, you have 7 days from completion to request a refund.

Why free online wills may not be the best option

You might be tempted to look for a free online will maker, but these options aren’t always the best idea. Many of them have limited customization options, making them less valuable if you have a more complex estate.

They also often have hidden fees, such as for downloading, printing, or notarizing. Many states have specific compliance policies, meaning you risk creating an unenforceable will. It’s never fun to spend money, but when it comes to your will, it’s worth it.

Benefits and drawbacks of online wills

Online wills come with their own sets of benefits and drawbacks. For the most part, online wills are more convenient and affordable than spending time and money meeting with a lawyer. They often take less than an hour to create and usually don’t require any special documentation (the longest on this list took testers about 40 minutes). Remember that just creating the documents doesn’t mean the will is finished. You’ll still need to formally sign the will in the presence of a witness.

Using an online will platform can benefit those who are looking to:

- Ensure their assets go where they want

- Name guardians for children, pets, or dependents

- Spend a few hundred dollars at most

- Avoid probate

“Losing a loved one is hard enough,” said Fracassa, the attorney in Missouri. “Without clear legal instructions, your family may face confusion, disputes, or drawn-out court processes. A solid estate plan brings peace and direction during an otherwise difficult time.”

But online wills are often more limited, making them not as useful if you have a complex estate, such as a large trust or multiple properties. And depending on your needs, you might end up having to pay for attorney assistance anyway (though for much less than a traditional hourly rate).

"Online estate planning resources are a cost-effective way to get essential documents done if money is tight or you need something quickly. However, if you have the financial capacity and time, consulting with an estate planning attorney may help uncover additional benefits like tax planning or probate avoidance that these services cannot provide."

—Allison L. Harrison, attorney at ALH Law Group in Columbus, Ohio

Frequently asked questions

Are online wills legit?

Yes, online wills created through a legitimate website, such as LegalZoom or Trust & Will, are legitimate (so long as they’re executed following the state-specific requirements). Always check a company’s data privacy policies before giving your information to a site.

Are online wills accepted in every state?

No, online wills are not accepted in every state. Check your location before creating one on any of the websites above. Each site will tell you (before you start creating a will) whether an online will is accepted in your state.

How long does it take to make a will online?

The average online will maker takes less than an hour, but it depends on your specific needs and goals. More complex estates may take longer.

What security measures should I look for in an online will maker?

You should look for security measures such as password protection, secure payment processing, a transparent privacy policy, and SSL encryption in an online will maker.

Do I need a lawyer to create a will online?

No, you don’t need a lawyer to create a will online. But you may want to consult a lawyer if your estate is complex or you want to include special instructions.

Do I need to notarize my online will?

No. In most states, you do not need to notarize a will for it to be legally recognized. But notarizing your will may help speed up the probate process.

Questions? Email us at reviewsteam@ncoa.org