Related Topics

After you leave the workplace and no longer collect a steady paycheck, you'll need money to cover essentials like food, housing, and health care. That's where Social Security comes in. This system was enacted in 1935 to keep workers from falling into poverty upon retirement. It was designed to provide basic retirement benefits for workers reaching age 65.

How much does Social Security pay?

Social Security monthly benefits can be as high as $5,108, but benefit payments are regularly adjusted based on the Consumer Price Index (CPI) increases. Thse payments are guaranteed and supported by the Social Security Trust Fund and provide half or more retirement income for many retirees.

Who qualifies for Social Security?

Workers who pay (or have paid) Federal Insurance Contributions Act (FICA) taxes are covered by Social Security. After paying into the system for at least 40 quarters (10 years on average), they are fully insured and will be eligible to receive retirement income benefits.

These benefits are based on a worker’s highest earnings over a 35-year period. If a worker has not paid into the Social Security system for 40 quarters, they are not eligible for full Social Security retirement benefits.

When should you file for Social Security?

Social Security can be received any time after age 62. But filing prior to the full retirement age and continuing to work will reduce your benefit amount based on the amount earned. In 2025, earning less than $23,400 annually will not affect your benefit amount.

Until you reach full retirement age, earning more than $23,400 will affect the amount you receive—for every $2 earned, your benefit will be reduced by $1. In the year you reach full retirement age, the earning threshold increases to $62,160. Earning more will reduce the benefit by $1 for every $3 earned over the limit. Upon reaching full retirement age, there is no deduction to your benefit based on earnings.

How do you apply for Social Security?

It's best to apply about three months before you want benefits to start. You can apply for Social Security in three main ways:

1. Apply online

- Go to the SSA's secure online application.

- Complete the application form and submit it electronically.

2. Apply by phone

- Call the SSA at 1-800-772-1213 (TTY: 1-800-325-0778).

- A representative will schedule a call with you and take your application information over the phone.

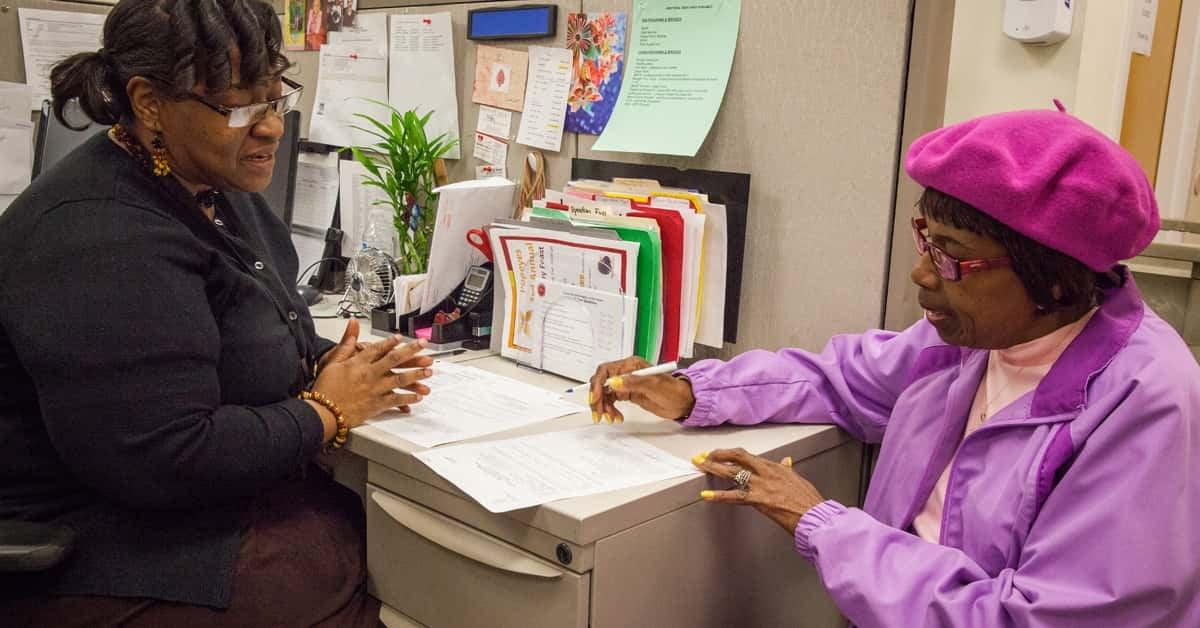

3. Apply in person

- Contact your local Social Security office to make an appointment. You can find your local office by using the SSA's locator tool or by calling their toll-free number.

- Bring required documents such as your birth certificate. Social Security care, W-2s or self-employment tax returns, and proof of U.S. citizenship or lawful residency (if you were not born in the U.S.).

You can track the status of your application online by creating a "my Social Security" account.