One of the most common Medicare-related questions is “Does Medicare pay for prescriptions?” While original Medicare (Parts A and B) does not cover prescriptions, you can purchase a Medicare Part D plan. This plan provides additional prescription drug insurance that covers a portion of your medication costs. You can also obtain prescription coverage through a Medicare Advantage (Part C) plan that offers this benefit.

The Inflation Reduction Act (IRA) of 2022 has helped millions of older adults reduce their prescription drug costs. Changes that have taken effect as a result of this legislation include:

- Capping monthly insulin costs at $35

- Making Part D vaccines free for all Medicare beneficiaries

- Eliminating the 5% coinsurance for Part D catastrophic coverage

- Requiring drug companies to pay rebates if drug prices rise faster than inflation

- Limiting Part D premium increases through 2029

Starting in 2025:

- Annual prescription drug cost sharing is capped at $2,000. That means once you out-of-pocket costs reach $2,000, your Part D plan pays 100% for covered medications for the rest of the plan year.

- The Part D coverage gap (which temporarily limits teh amount your Part D plan will pay for drugs) is eliminated.

- You can opt for a payment plan that allows you to break high drug co-payments into more affordable monthly installments.

How much does Medicare Part D cost in 2025?

Medicare will pay part of the costs of prescription drug coverage for everyone who enrolls in a Part D plan. How much you pay will depend on which prescription drug plan you choose. If you receive Medicare benefits and have low income, you may qualify for the Part D Low Income Subsidy (LIS), also known as “Extra Help.” Extra Help helps eligible people pay for their prescription drug costs.

Just like original Medicare, Part D involves certain out-of-pocket costs (cost you are responsible for paying). These include:

Premium

The premium is the monthly cost of maintaining your prescription drug policy. Premiums for Medicare Part D differ from plan to plan. However, the average estimated premium in 2025 is $46.50.

Deductible

A plan with a deductible will not pay for your prescriptions until you pay the deductible amount out-of-pocket. The highest deductible a plan can charge in 2025 is $590. Some plans offer $0 deductible and will pay for your prescriptions right away. Other plans may offer a deductible lower than the maximum of $590 such as $150 or $250. You will generally only want to choose a plan with a $0 deductible if it also has the lowest overall cost per year, including the costs for the drugs you take.

Copayments and coinsurance

A copayment, or copay, is a fixed dollar amount for your prescriptions. For example, you might have to pay $5 for a generic drug, $25 for a "preferred" brand name drug and $40 for a non-preferred brand name drug.

A coinsurance is a percentage of the price of your prescription. Typically plans require coinsurance for drugs listed in higher tiers like tier 4 and tier 5 drugs. For example, if your prescription costs $350, and your coinsurance is 25%, you will pay $87.50.

It is possible that some of your medications require a fixed copayment and others a coinsurance. Be sure to check the cost of each medication you take with the plan. You generally only want to select a plan with low copays or coinsurance if it also has the lowest overall annual cost per year, including the costs for the drugs you take.

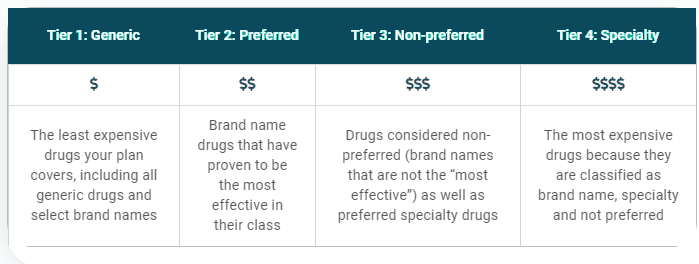

What are copay tiers?

Each plan places the drugs it will pay for in different levels, called tiers. Each tier has its own copay or coinsurance amount. Your drugs may be included in all the plans in your area, but they could be listed on different tiers with different copay amounts.

Part D Copay Tiers

What are the phases of Part D prescription drug costs?

Your prescription drug costs may change throughout the year depending on which phase of Part D coverage you are in. In 2025, Medicare Part D will implement a $2,000 annual cap on out-of-pocket spending for prescription drugs. Once you reach this limit, your plan pays 100% of your covered medication costs for the remainder of the year.

This new structure simplifies the Part D benefit by removing the coverage gap phase, resulting in three coverage stages:

- Deductible period: During this time, you will pay the full negotiated price of your drugs until you meet your Part D deductible. After you have met your deductible, your plan will begin to cover the cost of your drugs. The maximum Part D deductible is $590 in 2025.

- Initial coverage period: This period occurs after you have met your deductible and your plan begins to cover your drug costs. How much does Medicare pay for prescriptions? During this period, your plan will cover some of the drug cost and you will pay your copayment or coinsurance. Each plan defines the amount of time that you will remain in the initial coverage period.

- Catastrophic coverage: This period begins after you have paid $2,000 in out-of-pocket costs in 2025. This amount is based on how much you spend on prescription drugs, not how much your plan also pays towards your prescription drugs or total drug costs (see more detailed information below in "What counts as my "true" out-of-pocket costs?").

Each plan will encourage you to use the lowest-cost drug to treat your medical condition. A drug on a lower tier will cost less than a drug on a higher tier.

When does the coverage gap begin?

In Part D, you and the plan you join share the cost of drugs. The money that you spend is called your out-of-pocket costs. These costs determine if and when the catastrophic coverage begins. In 2025, the catastrophic coverage starts when you have paid $2,000 out-of-pocket.

- Once you have spent $2,000 for drugs in 2025, you would then pay 0% of the cost of your drugs for the rest of the calendar year.

- There is no cap or limit on the amount of prescription drugs you can get after you have spent $2,000 out-of-pocket.

Your drug plan will keep track of your out-of-pocket drug costs. They will send you a report each month you buy prescription drugs.

Medicare divides drug costs into two different groups:

- Your "true" out-of-pocket costs, or drug costs that count toward the start of your catastrophic coverage

- All other drugs you bought that do not count toward your catastrophic coverage

What counts as my "true" out-of-pocket costs?

Your true out-of-pocket costs are money you paid for covered drugs. This includes your copays and drugs you paid for to meet your deductible. It also includes most of the amount the drug manufacturer pays for brand name drugs while you are in the coverage gap.

What does not count toward my share of the costs?

- The premium for your drug plans (Medicare Part D plan or Medicare Advantage prescription drug plan)

- Drugs you bought that are not on your plan's drug list (formulary). Note: If you and your doctor get your plan to approve a drug not on the plan's drug list, the costs for that drug do not count toward your share of the costs and catastrophic coverage.

- Costs that third parties—such as employers and union insurance plans—paid for you

- Drugs you bought that Medicare does not cover

- Drugs you bought from a pharmacy that was not in your plan's network

- Over-the-counter drugs

Questions about your current Medicare plan?

What is the average cost of supplemental insurance for Medicare? Can Medicare pay for a caregiver? Choosing the best Medicare plan is a personal decision that should align with your health care needs, retirement goals, and expected lifestyle.

If you need help navigating your options, consider reaching out to your local State Health Insurance Assistance Program (SHIP). Available nationwide—including Puerto Rico, Guam, Washington, D.C., and the U.S. Virgin Islands—SHIPS offer free, objective, and tailored support to Medicare-eligible adults and their families and caregivers. They're staffed by trained counselors who can help you explore coverages and answer any questions you have about medical care and treatment.

Find your local SHIP office here or call 1-877-839-2675.