Related Topics

Original Medicare (Part A and Part B) covers many important health care services for older adults. But it does not cover everything. Medigap is a supplemental insurance policy that helps “fill the gaps” in original Medicare by covering out-of-pocket costs such as copayments, coinsurance, and deductibles. It cannot be used with Medicare Advantage plans. Medigap plans are sold by private carriers but regulated by individual states and the federal government.

How many Medigap plans are there?

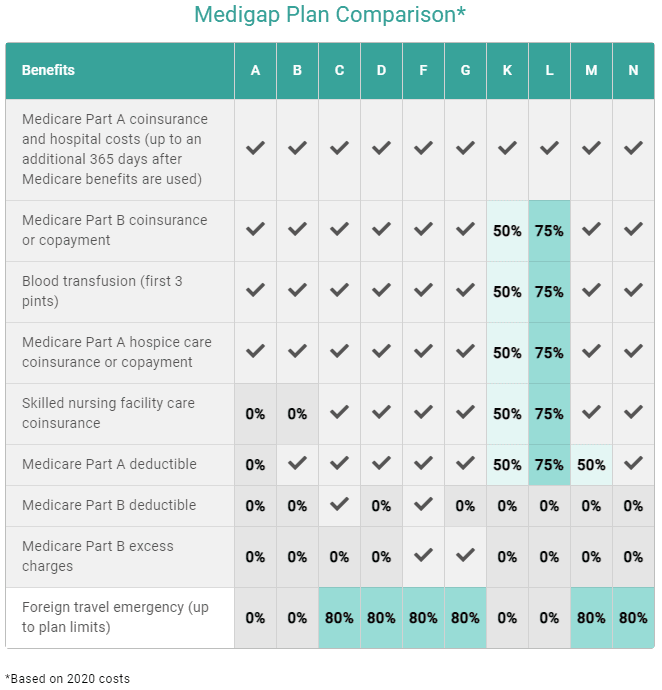

There are 10 standardized, federally approved Medigap plans available in most states. Each plan is known by a different letter: A-D, F, G, K-N—and each lettered plan provides a distinct type of coverage. As of 2020, Medigap plans C, F, and high-deductible F are no longer being sold to new Medicare enrollees—including those who turned 65 or became eligible due to disability or diagnosis on or after January 1, 2020. Massachusetts, Minnesota, and Wisconsin all have their own standardized Medigap plans.

How much does Medigap cost?

Every insurance company sets its own Medigap premiums. According to KFF, in 2023 the average Medigap premium was $2171, though this cost can vary depending on the type of plan. Your Medigap premium is the monthly amount you pay to the insurance company to maintain your coverage. It does not represent your out-of-pocket costs for medical services—those are separate.

Certain Medigap plans have spending caps, which limits what you'll pay during the policy period. The 2026 out-of-pocket maximum for Medigap plan K is $8,000. For Medigap plan L, the cap is $4,000. After you reach these limits, the plan will pay 100% of your costs for approved services for the remainder of the year.

The chart below provides a basic idea of the different benefits Medigap policies cover.

When can I enroll in Medigap?

You can enroll in Medigap when you sign up for Medicare Part B. Your six-month “Medigap Open Enrollment” period begins the first month you have Part B (and you’re age 65 or older). During this period, you:

- Choose any Medigap policy, which gives you a wide range of prices and coverage options

- Purchase any Medigap plan sold in your state (you cannot be denied coverage due to pre-existing health conditions)

- Shorten (or avoid altogether) waiting periods for a pre-existing condition if you buy a Medigap plan to replace creditable health care coverage (e.g., employer-sponsored coverage

If you miss your Medigap Open Enrollment Period, you'll have fewer plan options to choose from and you may have to pay a higher premium. In addition, insurance carriers are permitted to deny you coverage based on medical underwriting outside of the regular enrollment window.

Does Medigap cover all doctors?

With Medigap, you may visit any doctor whether they accept Medicare assignments or not. Keep the following in mind:

- If the doctor accepts Medicare assignment, your Medigap insurance company will usually pay the doctor directly.

- If the doctor does not accept Medicare, they can charge an additional 15% for their services (called the “limiting charge”). You may also be required to pay the full amount out of pocket at the time of service, file your own claim, and then get reimbursed by your insurance carrier.

Medigap plans generally do not pay for care received outside of the United States. One exception is medically necessary emergency care that occurs during the first 60 days of a trip.

What is the trial period for Medigap?

By law, when you buy a Medigap policy, there is a 30-day “free look” or trial period. You can cancel your plan, and receive a refund, if you’re not satisfied with your policy during this trial period. This is a good opportunity to make sure you’re comfortable with your plan’s coverages and costs.

If you miss your Medigap Enrollment Period, you may still have the right to buy a Medigap policy (without penalty) in certain circumstances—such as if your Medicare Advantage plan stops servicing your area. Situations like this are referred to as "guaranteed issue right" situations.

Contact your state insurance department to learn more about your Medigap options. Also, Medicare.gov offers an online tool to help you find out if you are legally able to switch or drop Medigap policies.

For more information on buying a Medigap policy, see the latest Medicare & You handbook.

Source

1. KFF. Key Facts About Medigap Enrollment and Premiums for Medicare Beneficiaries. October 18, 2024. Found on the internet at https://www.kff.org/medicare/key-facts-about-medigap-enrollment-and-premiums-for-medicare-beneficiaries/