Building Money Management Skills Among Underserved Populations

7 min read

As part of NCOA's work to improve the financial security of older adults, and with support from the Bank of America Charitable Foundation, a new digital tool called Budget CheckUp launched in 2022. The tool consists of a short assessment, recommendations based on the assessment responses, and a simple budgeting calculator to help older adults manage their basic expenses.

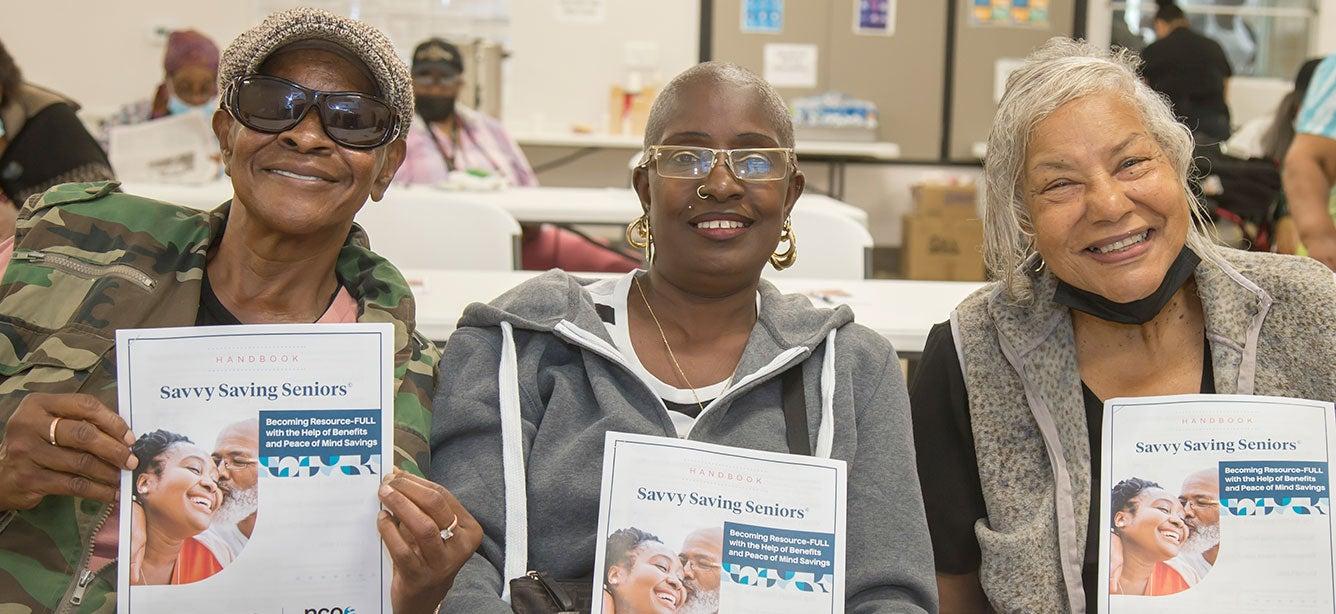

First, NCOA tested the digital tool at three pilot sites in California, Florida, and Texas. The pilot program proved such a success, outreach expanded nationwide in 2023.

Some key takeaways and next steps:

- Women were more likely to participate in the program.

- Participants were more likely to be Medicaid recipients between the ages 18-49 or Medicare 65-74 years old.

- More Asian or Asian American and Black or African American clients were interested in learning about money management and budgeting resources.

- Many participants at a one-hour Los Angeles budget workshop said they felt rushed. Based on this feedback, NCOA is exploring opportunities to modify the workshop to allow more time for participants to digest each topic area.

- Based on the need, NCOA will expand the program in 2024 to offer more budgeting workshops across the country.

This report highlights NCOA’s accomplishments providing the educational content and resources needed for community organizations to participate in a budgeting assistance pilot project.