Living Trust vs. Will: Key Differences

Key Takeaways

- A will is a simple legal document that provides instructions on how to distribute property to beneficiaries after death, while a trust is a complex legal contract that allows you to transfer your property to an account to be managed by another person.

- If you want to ensure there are no gaps in your estate plan, you can have both a living trust and a will.

- Creating a living trust is a good option for those with a complex estate (multiple properties, investment accounts, and/or sizable assets).

- You can use an online will maker to create a will for $0–$199 and a trust for $139–$440.

Whether you’re just starting the estate planning process or looking to update an existing plan, understanding the options available will give you peace of mind knowing your assets will be distributed according to your wishes. One of the most common estate planning decisions is choosing a living trust versus a will. While they may seem similar, the two have some significant differences.

A will is a simple legal document that provides instructions on how to distribute property to beneficiaries after death, while a trust is a complex legal arrangement that allows you to transfer ownership of property, is managed by a third party, and is distributed to beneficiaries at any time determined by the creator of the trust. In this article, we’ll compare and explore the advantages and disadvantages of each, so you can make an informed decision about which is right for your needs.

Creating a living will and trust online

If you have a relatively straightforward estate, you may want to consider online estate planning services, such as an online will maker. They tend to cost less, and they’re designed to be customized to your particular circumstances while still meeting individual state requirements.

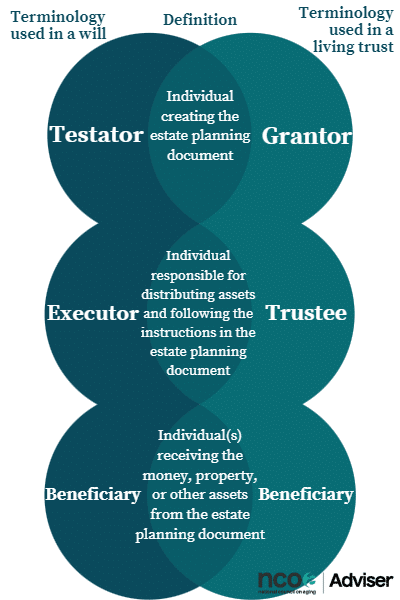

Will and living trust terminology

Before diving into the differences between a will and a living trust, you should know that estate planning tools are created and governed by state law. This means, what might be true for an estate in one state, might not be true for an estate in another state. The information below will cover general details about the tools in all states. Visit a local estate planning attorney’s office for more information about estate planning in your specific state.

Will pros and cons

What is a will?

A last will and testament, or simply a will, is a legal document outlining your wishes for the distribution of your property and assets after you die. With a will, you typically assign an executor, who is responsible for carrying out the wishes and instructions outlined in the will.

Your will can be as detailed or as generalized as you want. For example, you can leave everything you own to a single beneficiary ⓘA beneficiary is someone entitled to receive money, property, or other assets from a trust or will., or assign specific items or sums of money (called a bequest) to numerous beneficiaries. You can make plans for anything you own, from your smallest items, like sentimental keepsakes or jewelry, to large assets, like your home or car. You may also leave money or items (like artwork, clothing, or furniture) to your favorite charity. In addition to details about distributing assets, you can include instructions for the care of any dependents or pets you may leave behind.

Creating a last will and testament is an important step in estate planning because it ensures your assets are distributed according to your wishes and can help prevent disputes among family members or other beneficiaries. After creation, your will can be modified using an amendment, called a codicil, or you can write an entirely new will to replace it.

Your estate goes into the probate ⓘProbate is a court-supervised proceeding in which a will is proved and recorded as the deceased’s authentic last will and testament. process when you die, which is when your will is recorded with the state. Assets or items in the will can’t be distributed until probate is complete. For some estates, it can take months, or even years, to leave probate.

The difference between a will and a living will

While researching, you may have also come across the term “living will.” A living will and a will are two different documents with distinct purposes.

A will outlines a person’s wishes for their assets and property that will be distributed after their death. In contrast, a living will outlines a person’s wishes for medical treatment and health care decisions if they’re unable to communicate their wishes. A living will guides loved ones and medical professionals on matters that include life-sustaining treatment, pain management, and organ donation.

It’s critical to have both a will and a living will in place to ensure your wishes are carried out both in life and after death.

Living trust pros and cons

What is a living trust?

A living trust is a legal arrangement that allows you to transfer ownership of your assets to a trust account for various financial purposes, including estate planning. You’ll assign a trustee ⓘThe trustee is the individual responsible for managing the assets in the trust. to be responsible for the assets in the account on behalf of the beneficiaries. The assets within the account will be distributed after death or at any other time you choose.

A living trust is created when a person, called a grantor ⓘThe grantor is the individual who is giving the assets to the trust., signs a trust agreement. When used as an estate planning tool, the agreement typically includes details about the purpose of the trust, the types of assets that can be held in the trust, the duties and responsibilities of the trustee, and the designated beneficiaries who will receive the assets in the account after the grantor dies.

Next, the grantor transfers ownership of their assets and property to the living trust account. The grantor can assign themselves as the trustee if the trust is revocable, or they can assign a third party to manage the account. The main advantage of using a living trust is avoiding probate court, which means your beneficiaries can access the assets as soon as you die.

Helpful hint: The assets in a trust account can still gain value, such as rental income from properties or capital gains from money market investment accounts. Your trustee will have a legal and ethical duty to protect the integrity of those accounts and keep them productive for your beneficiaries. This means, when picking a trustee, you should select someone financially responsible and organized.

A living trust comes in two varieties: revocable and irrevocable—both offer advantages.

Revocable living trust

A revocable living trust is the most commonly used trust for estate planning purposes because it allows you to maintain control over the trust and make changes during your lifetime. This means you can add or remove assets, change beneficiaries, or even revoke the trust entirely if you wish. With this kind of trust, the grantor can assign themselves as the trustee or appoint a third party.

But because you still retain control over the assets in a revocable trust, they’ll be considered part of your estate for tax purposes. When the assets get distributed, your beneficiaries must pay estate taxes.

Irrevocable living trust

An irrevocable living trust cannot be changed or revoked once created. When you transfer ownership of the assets to the trust, you give up control over them, and you must appoint a third party as the trustee. This also means you can’t change the terms of the trust or access the assets unless you meet certain criteria.

For example, you can only change the terms of the trust if all the beneficiaries agree to do so. You can also terminate the trust if all the assets in the trust get distributed to beneficiaries and the cost to maintain the trust becomes more than the trust fund is worth. One main advantage to giving up control over your assets to an irrevocable trust is protection from creditors. For example, if you borrow money and aren’t able to pay back the loan, a lender can’t get their payment from assets held in an irrevocable trust. This protection works differently in every state, so for more information on how an irrevocable trust can protect your assets, you should consult with a local estate attorney.

Another benefit of an irrevocable trust: since you no longer own the assets, they are not considered part of your estate, which can have potential estate tax benefits. An estate tax is “a tax on your right to transfer property at your death.”1 As of 2023, the federal estate tax only applies to estates exceeding the set $12.92 million exemption amount ⓘAn exemption is a set amount of money that’s deducted before calculating the estate tax..2 Some states do not have state-specific estate taxes, and the exemption amount and rate varies for those that do.3

Law in real life: If your estate is in Washington, the exemption amount is $2.19 million, and the estate tax ranges from 10%–20%, depending on the size of the taxable estate (the value exceeding $2.19 million).4 If your estate is worth $3.19 million when you die, only $1 million is taxable at the applicable 10% rate. This means the estate tax is $100,000.

For most people, their estate will not exceed the federal or an applicable state exemption amount, so creating an irrevocable trust would not be worth it for the tax benefit alone. Every case varies, so you should consult with an estate planning attorney to determine whether creating an irrevocable trust is best for you.

Living trust vs. testamentary trust

Think of a testamentary trust as a combination of a will and a living trust. Unlike a living trust, which becomes effective during a person’s lifetime, a testamentary trust is created by a person’s will and only takes effect after the person’s death.

The testator’s assets are transferred to the trust at the time of their death, and the trustee is responsible for managing and distributing the assets according to the instructions in the will. A testamentary trust is common in scenarios where assets are set aside for minor children or other beneficiaries who may not be capable of managing their inheritance themselves.

What is the difference between a will vs. a living trust?

Our team heard from Mary Vandenack, a licensed attorney with a focus on estate planning and is an Accredited Estate Planner® (Distinguished) Nominee. Vandenack identified “the major distinction between a will and a trust is that for a will to take effect, a court proceeding called a probate must be initiated. A trust does not require probate.”

The three main differences between a living trust and a will are:

- A will won’t be effective until after the testator dies, while a trust goes into effect immediately after it’s signed.

- A will typically goes into probate after the testator dies, while a trust does not.

- A will is a set of instructions for after death, and a living trust is an account that is funded by a person’s assets while they’re alive.

Table 1 Comparison between wills and living trusts

Feature | Enters probate court | A private document | Manages assets if you become incapacitated | Governs assets owned by you at death | Protects assets from creditors |

|---|---|---|---|---|---|

| Will | Yes (Almost all estates governed by a will enter probate court before assets can be distributed) | No (Becomes part of the public record during the probate process) | No (A will only goes into effect after a person dies) | Yes (Governs any assets owned by you after you die) | No (Assets and property named in a will remain under your control until death, so creditors can go after them if you miss payments) |

| Trust | No (Assets within the trust are immediately available to beneficiaries after grantor’s death) | Yes (Details of the trust are only available to the grantor, trustee, and beneficiaries) | Yes (A trust is effective as soon as the document is signed and remains until the time predetermined by the grantor) | No (Only ever governs assets owned by the trust) | Yes, if it’s irrevocable (Irrevocable living trusts take on full ownership of the transferred assets, so your creditors can’t get to them if you miss payments) |

Is a living trust better than a will?

Deciding which is “better” depends on your estate planning goals and several other factors, such as:

- Your estate planning budget

- The size of your estate

- Whether you’ll need to access the assets in your estate before you die

- The complexity of your distribution wishes (how many beneficiaries you have and the types of items you’re dividing)

For most people, making a will is the easiest, fastest, and most affordable way to plan. For others, a trust might be a better choice.

A will may be better if:

- You want to keep ownership of your property and assets before you die

- You need to put an estate plan in place quickly

- You want a simple and affordable estate planning option

A living trust may be better if:

- You want to maintain privacy over your property or assets

- You have several real estate properties

- You have significant assets

- You want to protect your finances from creditors

- You want more control over how your assets are distributed after you die

Can you have both a will and a living trust?

A person can have a will and a living trust. While for some, it might only make sense to have a will, it’s recommended that all individuals who choose to have a trust also have a will. This ensures anything not specifically held by the trust can pass to beneficiaries without being subject to your state’s intestacy laws. Many online will-maker services can help you affordably create a will and a simple living trust. For example, all of LegalZoom’s trust bundles include a pour-over will and living will in addition to a trust.

What to consider when making a will

Your will becomes your voice after you die, and it’s the final word on how your belongings will be handed down. If you die without a will, known as dying intestate, you’ll have no control over how your things are divided. All the property you own at the time of your death will be distributed according to the laws of the state where you live.

Law in real life: If a person dies without a will in Virginia, their property and assets (after payment of debts and court fees) are distributed as follows:

- To the surviving spouse (unless they have children with someone other than the surviving spouse, in which case, one-third goes to the surviving spouse and the remaining two-thirds is divided among all children)

- If no surviving spouse, all passes to the children and their heirs

- If no surviving spouse or children, then all goes to the deceased’s father and mother or the survivor

- If no surviving spouse, children, or parents, then all passes to the deceased’s brothers and sisters and their heirs5

Any wishes you make in your will are carried out by your executor and enforced by the court. The more specific you can be about your wishes the better. If the wording of your will is broad or vague, a judge will need to interpret your wishes, which may conflict with what you intended.

Information you’ll want to gather before creating your will:

- Primary bank account information (checking and savings)

- Retirement and other investment account information

- Life insurance policy numbers

- Proof of ownership of assets (car title or deed to your home)

- Full name(s) and contact information of the executor(s) of your estate

- Full names and contact information for all individuals you plan to name in your will

What to consider when making a living trust

For most people, a will is sufficient for their estate planning needs, but you may want to use a living trust to keep your estate out of probate and give your beneficiaries access to what they’re entitled to as soon as you die.

On average, it will cost more to create a living trust than a simple will. While it’s possible to affordably create a trust using an online service, if you have a sizable estate, it’s recommended that you speak with an attorney before creating a trust.

Next, you’ll need to consider how much control you want to have over the trust. If you want the ability to make changes or revoke the trust, a revocable living trust may be the better option for you. If you’re looking for potential tax benefits and are comfortable giving up control over the assets, an irrevocable living trust may be a better fit.

Information you’ll want to gather before creating your living trust:

- Contact information for the bank that will be holding the trust account

- Current bank account information (checking and savings)

- Retirement and other investment account information

- Life insurance policy numbers

- Proof of ownership of assets (car title or deed to your home)

- Full name(s) and contact information of the trustee(s) of your account

- Full names and contact information for all individuals you plan to name as a beneficiary

What is the cost of a living trust vs. will?

Cost estimations

Will: $0–$1,000 (one-time creation cost); $0–$300 (lifetime maintenance cost)

Living trust: $139–$3,000 (set-up cost); $2,500–$7,000 (lifetime maintenance cost)

When deciding to make a last will versus a living trust, affordability is one of the most important factors. It costs significantly less to create a will than a living trust. This is because a will is a simple document that you can create yourself or with an online will-maker service for $0–$199. Even if you use an estate planning attorney, it won’t usually cost more than $1,000, depending on where you live.

A trust is significantly more complex. You’ll need to create a trust document that meets your state’s standards, create a trust account, and transfer assets. Some online will-maker services can also help you create a simple living trust for $139–$440, like LegalZoom and Trust & Will.

Even with the help of online customer support, moving money to and from accounts and transferring property deeds can be difficult without legal assistance. For that reason, most people who want to create a trust will need to hire an attorney. To set up a living trust, legal fees range from $1,500–$3,000. This doesn’t include maintenance fees, which can cost several thousands of dollars over the lifetime of the trust.

Why you can trust us

Our team consists of trained lawyers who have spent hundreds of hours researching estate planning and using the services we recommend. We only recommend services we find to be helpful and accurate. To develop our reviews and guidance, we:

- Spent 300 hours researching and using online estate planning services

- Consulted with legal experts, probate attorneys, and financial planners to learn the best practices in estate planning

- Went behind the paywall to gain firsthand experience with five of the top online will creation services to review and compare them with each other

- Read hundreds of customer reviews on trusted third-party websites, such as Better Business Bureau (BBB) and Trustpilot

Bottom line

While there are multiple ways you can prepare your estate for after you die, the most common is to create a will or a living trust. Unless you have a complex estate (multiple homes, large savings account) a will is likely the easiest and most affordable way to plan for your death. If you’re looking for an affordable option that comes with helpful customer support, many online estate planning services can help simplify the will- and trust-making processes.

Frequently asked questions

The main purpose of a living trust is to provide a flexible and efficient way to manage and distribute assets after the grantor’s death while avoiding the costly and time-consuming probate process. It can also provide privacy since the details of the trust are not made public as they would be in a probate court proceeding.

Choosing the best type of trust depends on what you prioritize in the estate planning process. For example, an irrevocable living trust is best if you’re trying to minimize taxes, but if you want to prioritize flexibility and reserve the right to revoke your trust, a revocable living trust is likely the better option.

The disadvantage of creating a living trust versus a will is the cost. On average, a will costs between $0–$1,000 to create. But because of its complexity, a living trust costs between $139–$3,000 to create and between $2,500–$7,000 to maintain.

Whether a trust or a will is better depends on your estate planning goals. A living trust may be better than a will if:

- You want to maintain privacy over your property or assets

- You have several real estate properties

- You have significant financial assets

- You want to protect your finances from creditors

- You want more control over how your assets are distributed after you die

The three most common types of trusts are: living, revocable, and irrevocable. A living trust is one that’s created while you’re still alive and can be revocable or irrevocable. A revocable living trust can be changed while you’re still alive. An irrevocable living trust can’t be changed after it’s created.

Have questions about this review? Email us at reviewsteam@ncoa.org.

Sources

- IRS. Estate Tax. Oct. 26, 2022. Found on the internet at https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

- IRS. IRS Provides Tax Inflation Adjustments for Tax Year 2023. Oct. 18, 2022. Found on the internet at https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2023

- Tax Foundation. Does Your State Have an Estate or Inheritance Tax? June 21, 2022. Found on the internet at https://taxfoundation.org/state-estate-tax-inheritance-tax-2022/

- Department of Revenue Washington State. Estate Tax Tables. Found on the internet at https://dor.wa.gov/taxes-rates/other-taxes/estate-tax-tables

- Virginia Court Clerks’ Association. Probate in Virginia: Administration of Estates. July 2019. Found on the internet at https://www.vacourts.gov/courts/circuit/resources/probate_in_virginia.pdf