What Is a Power of Attorney (POA) 2025?

Key Takeaways:

- A power of attorney, or POA, is a legal document that allows you to give someone else the authority to make decisions on your behalf.

- Using an attorney to craft your POA can cost you more than $300. Using an online service like LegalZoom can be a more affordable option, starting at just $39.

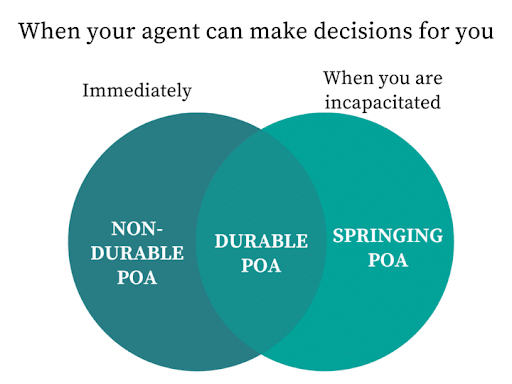

- A durable POA is effective from the moment you sign it and does not expire; a non-durable POA is only effective for a limited period of time; and a springing POA will not become effective until you’re declared incapacitated.

- You can create a limited POA that only applies to certain types of decisions, such as medical care or finances.

Powers of attorney are an extremely useful tool in estate planning. They can be used to help you make many types of decisions—buying a car, choosing an insurance provider, or even paying your bills. Having a POA in place will ensure you have a trusted person to act for you when you can’t.

This article will explain what is a POA, what it can and can’t do for you, and how you can get one. If you are also considering creating a will, read our in-depth review of the best online will makers.

Why you can trust our expert review

Our team consists of trained lawyers who have spent hundreds of hours researching estate planning and using the services we recommend. We only recommend services we find to be helpful and accurate. To develop our reviews and guidance, we:

- Spent 300 hours researching and using online estate planning services

- Consulted with legal experts, probate attorneys, and financial planners to learn the best practices in estate planning

- Went behind the paywall to gain first-hand experience with five of the top online will creation services to review and compare them with each other

- Read hundreds of customer reviews on trusted third-party websites, such as Better Business Bureau (BBB) and Trustpilot

“Power of attorney” meaning

A power of attorney is a legally binding document—not an individual—that allows you to appoint someone to manage your real property (real estate), personal property, or medical or financial affairs for you, according to the Consumer Financial Protection Bureau.1 In other words, it gives someone else the authority to make the decisions you would normally make, in the event you can no longer make them.

The person creating the POA is called the “principal.” The person being appointed with decision-making power is called an “agent.”

POAs are typically used by those who cannot manage their affairs, either due to mental incapacity or physical absence. This may be short-term (for example, due to illness or travel) or long-term (like with a severe brain injury or a coma), depending on the type of POA.

In the legal sense, someone is considered incapacitated if they lack the ability to make rational decisions according to the Legal Information Institute of Cornell Law School.2 This can be due to an illness, declined mental state, a disability, or simply being away for an extended period of time.

For more information about the importance of having a POA in place, our team spoke with Amanda Dorio, Esq. She practices in the areas of wills, trusts, estates, probate, and trust administration and is licensed to practice law in Florida and Wisconsin. Dorio shared that a “[POA] is a vital legal tool that empowers a trusted individual to manage your financial matters in case you can’t. It’s a smart way to ensure that your financial affairs are handled smoothly during unexpected situations rather than facing potential delays and complications without one.”

What does a power of attorney do?

A POA allows you to grant someone, also known as an agent, the authority to make your decisions for you.

A POA creates a “fiduciary relationship” between you and your agent. A fiduciary relationship is when one person is legally obligated to act in the best interests of another person. That means they’re responsible for making decisions for you, in the way you would want those decisions to be made.

Who needs a power of attorney?

POAs are typically set up for older adults engaged in the estate planning process. They are commonly included in estate planning bundles, so if you don’t yet have a will, you can get both of these documents at the same time.

If you want to create a power of attorney for a parent or loved one, you’ll want to do it as soon as possible. Once that person is declared incapacitated, they won’t be able to create a power of attorney. Instead, a judge will have to formally appoint a guardian to care for them.

Power of attorney limitations

You can set a limitation on either the scope or duration of the agent’s authority when you create a POA.

For example, a springing POA is limited because it won’t take effect unless you become incapacitated. A non-durable POA is limited by placing an expiration date on your agent’s authority. A financial POA limits the agent’s scope of authority to only financial decisions. No matter what type of POA you create, the agent’s authority will expire once you die.

Though your agent has complete decision-making authority over the affairs included in your POA, they are still required to act in your best interest.

For example, your agent will never be able to:

- Write your will or change it

- Transfer funds from your bank account to their own (without your consent)

- Make decisions after your death (unless they’re appointed to do so in your will)

- Transfer the POA power to someone else without your consent

Risks of a power of attorney

The main risk of having a power of attorney is your agent may make the wrong decisions on your behalf. Make sure your agent understands exactly what your wishes are and why they are important to you.

In rare cases, a POA can be abused by an agent who tries to take advantage of their power over your affairs, which is a crime, according to the National Center on Elder Abuse.3 That’s why it’s so important to choose an agent you completely trust to act responsibly.

To minimize this risk, you can craft a POA that includes certain safeguards such as:

- Naming multiple agents to act jointly

- Naming multiple agents to be responsible for particular decisions

- Naming a successor agent in case your initial agent passes away or otherwise can’t perform the responsibilities you’ve granted them

- Requiring the agent to approve decisions with a trusted probate attorney or accountant

How to set up a power of attorney

A POA is available in every state, but the requirements for creating and maintaining one will vary depending on where you live. Below is a step-by-step guide to help you navigate the POA process.

Step 1: Select an agent

Selecting an agent, also known as an attorney-in-fact, is one of the most essential steps in setting up a POA. This person will be responsible for making important decisions in your life when you no longer can, so you have to trust they’ll act in your best interest and carry out your wishes faithfully.

Many people choose a family member as their agent, but that’s not always the best choice depending on your circumstances. If you don’t want to risk starting disputes among family members, you can name an honest, longtime friend as your agent.

If you want an agent who is completely neutral, familiar with fiduciary relationships, and especially skilled at managing someone else’s affairs, you can name a trusted professional as your agent for a fee. Attorneys and accountants are common choices for POA agents due to their expertise in handling complex affairs. For example, you might benefit from having a financial POA that names an accountant as the agent if you’re receiving IRS notices for an incomplete tax return or “failure to pay.”

Here are some characteristics you should look for in your agent:

- Trustworthiness. Your agent should be someone you trust to do what’s best for you and your assets.

- Attention to detail. Your agent should be meticulously organized so they can accurately manage your affairs.

- Availability. Your agent should be capable of taking on the management of another person’s finances (e.g., paying monthly bills on time) without being overwhelmed.

- Assertiveness. Your agent should be willing to make the final decision on an important matter in your best interest, even if the decision upsets someone else.

Step 2: Discuss expectations and responsibilities with your agent

Once you’ve chosen the person you want to manage your affairs, you need to make sure they’re up for the job. This is vital to ensure your agent will make decisions that meet your expectations.

Be sure to discuss in this meeting:

- What a power of attorney document is

- The responsibilities they would have as your agent

- The time commitment required

- What you want them to keep in mind when making decisions for you

- Whether they think they can fulfill their duties while grieving

- Whether they’re comfortable making final decisions on disputed matters

- Whether they consent to being your agent

- Any other questions or concerns they may have

Step 3: Choose the right type of power of attorney

Not all POAs achieve the same outcome. You’ll want to choose the right type of POA based on your needs. To do this, you’ll need to make a duration distinction and a scope distinction.

Distinguish by duration

First, decide when you want your POA to go into effect:

- Want it to be permanently effective from the moment you sign it? Create a durable POA.

- Want it to be effective for only a limited period of time? Create a non-durable POA.

- Want it to not go into effect until you’re declared incapacitated? Create a springing POA.

Distinguish by scope of authority

Next, determine the scope of your agent’s authority:

- Want an agent to have authority over anything you’d normally have authority over? Create a general POA.

- Want an agent to manage only your health care decisions? Create a medical POA.

- Want an agent to manage only your finances? Create a financial POA.

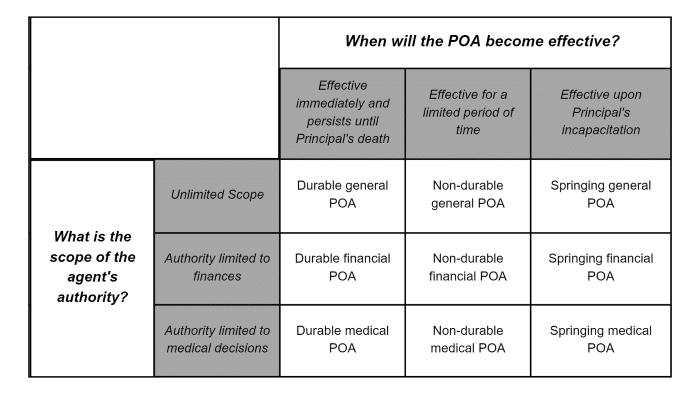

Once you’ve decided on the duration and scope of the authority you’ll be delegating to your agent, you can choose the type of POA you want using Table 1 below.

For example, if you want to delegate all your decision-making authority while you’re out of the country for one year to a POA , you’ll need a non-durable general POA. If you want a POA to have authority over your financial decisions if you ever become incapacitated, you’ll need a springing financial POA. Or, if you want a POA that goes into effect immediately and gives authority over any medical decisions for the rest of your life, you’ll need a durable medical POA.

Combining these two distinctions, scope and duration, will give your agent helpful information regarding their powers.

LegalZoom provides several options that fit into these categories at an affordable price. For example, you can obtain a standalone financial power of attorney for just $39 or a healthcare directive, which includes a healthcare power of attorney, also starting at $39. Both financial and healthcare POAs are included in all LegalZoom Estate Plan Bundles.

Table 1 POA classifications

Step 4: Draft the document

When it comes to drafting the POA document, you have some options. You have free options, such as finding free templates online, but you’ll have to input all the required information into a website without any guidance. This runs the risk of you incorrectly filling out the form and not creating the POA you intended to create.

If you want to ensure your POA does exactly what you want it to do, you can purchase an online service to create your POA for you. These services, such as LegalZoom, typically cost around $35–$45. All you’ll have to do is answer a simple questionnaire, which should take around 10–15 minutes to complete.

To answer the questionnaire, you’ll need the contact information for you and your agent (including name, phone number, address, etc.). The rest of the questions will be about what you want your POA to accomplish. Once you’ve finished the questionnaire, the service will generate a completed POA for you to print. If you don’t have a printer, you can usually use one at a local library or school. Some business centers (like UPS or FedEx) will provide printing services as well. Or, you can ask a friend or family member to print it out for you

The most expensive option is hiring a probate attorney to draft your POA. A probate attorney is a type of lawyer specializing in wills, trusts, and estate planning. Probate attorneys will typically charge a flat fee of around $200 to draft a POA for someone. So, unless you plan to have a highly complicated POA, hiring an attorney to draft the document is usually unnecessary since there are more affordable options.

Regardless of the method you choose, or which state you live in, your POA document should include the following:

- The type of POA it is

- The date you created the POA

- The start date and expiration date (if applicable)

- Your name

- The agent’s name

- The scope of the agent’s authority

- A clause detailing your wishes

Step 5: Execute the document

Executing a document means to make it valid and legally binding. The exact requirements for executing a POA will depend on your state’s laws.

The document should be signed by both you and your agent, showing you consent to allowing your agent to make decisions on your behalf and the agent consents to taking on the duties of making such decisions. Depending on the state you live in, you and your agent may need to sign the document in front of witnesses or a notary public for it to be valid. The requirements for each state are listed below:

Table 2 POA signature requirements by state

| Two witnesses and a notary | Florida, Iowa, Kansas, Kentucky, North Carolina |

| Two witnesses or a notary | Alaska, Arizona, Arkansas, California, Hawaii, Idaho, Illinois, Iowa, Kansas, Kentucky, Minnesota, Mississippi, Nebraska, New Hampshire, New Jersey, North Dakota, Ohio, Rhode Island, Tennessee, Texas, Wyoming |

| At least two witnesses | Alabama, Connecticut, Delaware, D.C., Georgia, Indiana, Louisiana, Maine, Massachusetts, Michigan, Missouri, Montana, Nevada, New York, Oregon, Oklahoma, Pennsylvania, South Carolina, South Dakota, Vermont, Virginia, Washington, West Virginia, Wisconsin |

| One witness and a notary | Maryland |

| Only a notary | Colorado, New Mexico |

| Only one witness | Utah |

Source: American College of Trust and Estate Counsel.4

Step 6: Maintain and update the document as needed

Once your POA is legally binding, you will need to stow it away for safekeeping. We recommend you keep the original in a fireproof lockbox at home (like this one for $30) or a safe deposit box at the bank where you, your agent, and your loved ones can access the document if you ever need to update it or refer back to it. It’s also a good idea you make copies of the document and share them with your agent, your attorney, and anyone else you think should have access to it.

Distinguishing different POAs

Powers of attorney are distinguished by both the duration they’re effective and the scope of authority that’s being granted. The duration distinctions are: durable, non-durable, and springing. The scope distinctions can either be general or limited. Limited POAs can be further classified based on what the scope is limited to. For example, a medical POA is a type of limited POA that only delegates authority over medical decisions. Or, a financial POA is a type of limited POA that only delegates authority over financial decisions. Each type can be useful depending on your needs.

Duration distinctions

You can classify a POA based on the duration of its effectiveness. In other words, the duration distinction will tell you when an agent has authority, and when the agent’s authority ends. All POA’s expire upon the principal’s death, but some POA’s will expire sooner. Similarly, while some POAs delegate authority to the agent immediately, others may not go into effect until something happens.

Durable POA

A durable POA becomes effective the moment it’s signed and will remain effective even after you’ve been declared incapacitated.

Example: Abe was recently diagnosed with an incurable brain disease. Abe got a general durable POA to appoint his wife, Carol, to manage his finances while he’s being treated in the hospital. One day, Abe’s health takes a turn for the worse and he slips into a coma—rendering him legally incapacitated. Since Abe’s POA is durable, Carol can continue acting on Abe’s behalf.

Non-durable POA

A non-durable POA will allow you to delegate decision-making responsibility to an agent for a limited period of time. You can specify the point at which your non-durable POA ceases to be effective in the document. It may be when you die, at the end of a time limit, at the occurrence of an event, or even just when you decide to revoke the privilege.

Example: Abe is a business owner who needs to leave the country for six months. Abe can create a non-durable financial POA to appoint Bob with the authority to make decisions on behalf of the company while Abe is away. Once Abe returns, the POA will expire. Abe can resume running his business, and Bob will no longer have any authority over the company.

Springing POA

A springing POA won’t be legally effective until an event specified in the document occurs—usually when someone is declared mentally incompetent or physically disabled. Think of it like a superhero who springs into action when you’re either physically or mentally unable to make decisions for yourself.

Example: Abe created a springing medical POA 15 years ago that delegates his health care decisions to Bob if Abe is ever declared incompetent. Abe is injured at work one day and develops severe brain damage. The springing POA becomes legally effective on that day, and Bob (as the appointed agent) is now responsible for decisions regarding Abe’s medical care.

Scope distinctions

The other way a POA is classified is based on the scope of authority given to the agent. To put it simply, a POA will either grant general authority or limited authority to someone.

General POA

A general POA grants an agent broad authority to make any decisions or take any legal actions on behalf of the principal.

Example: Abe has a general springing POA that names his wife, Carol, as his agent if he were to become incapacitated. So, if Abe gets injured and develops severe brain damage, Carol will have the authority to decide both how Abe is to be cared for and how his finances will be managed.

Limited POA

You can use a limited POA to restrict the scope of your agents to certain types of affairs. Most often, this is seen as either a medical POA or a financial POA. This allows you to split the responsibility over your affairs among multiple agents based on their strengths.

Example: Abe has two kids, Debbie and Eric. Debbie is a doctor, and Eric is an accountant. Rather than appointing Debbie as his sole agent and risk upsetting Eric, Abe could have two limited POAs. He can set up a medical POA delegating his health care decisions to Debbie and a financial POA delegating his financial decisions to Eric.

Medical POA

A medical POA, also known as a health care power of attorney, is a limited power of attorney that appoints an agent to make health care decisions on your behalf.

The duties of the agent of a medical POA can include:

- General medical care decisions (e.g., elective surgeries, treatments, etc.)

- Your insurance providers

- Which long-term care facilities you’ll be placed in

- Withdrawal from life-saving measures

- End of life care options

- Donation of organs

- Authorization for autopsy

Financial POA

A financial POA is another type of limited power of attorney that grants an agent authority over your financial matters.

The duties of the agent of a financial POA can include:

- Paying bills

- Opening and closing bank accounts

- Managing investment portfolios

- Engaging in financial transactions

Additional free or affordable estate planning resources

Learning about estate planning tools like the power of attorney can be intimidating, but it’s an important part of safeguarding your affairs. For more resources on how to begin preparing for your future, check out NCOA’s Age Well Planner. If you’re taking care of a loved one, read our advice about managing someone else’s legal, financial and medical decisions. And be aware of estate recovery, how it works, and how it can affect your or a loved one.

There are plenty of resources offering affordable legal aid. There are also non-profit organizations, such as the Veteran Legal Institute, that will provide free legal assistance to current and former service members.

Important terms to know

As you learn how to create a power of attorney, it may be helpful to know what certain legal terms mean:

- The agent, also known as the “attorney-in-fact,” is the person appointed to make decisions on another’s behalf.

- The principal is the person who delegates decision-making authority to someone else.

- An estate is all the assets, including real estate and personal property, that someone owns at the time of their death.

- Authority is legal permission to act on another’s behalf. A power of attorney allows you to grant someone else legal permission to act for you if you’re ever unable to make decisions on your own.

- Execution, in the legal sense, means signing something to make it legally binding. To make a power of attorney official, it must be signed by the principal, the agent, and witnesses. This is done to prove the document’s authenticity and accuracy.

The bottom line

A power of attorney is an important part of any estate plan. It allows you to appoint someone—who you trust will honor your wishes—to make decisions on your behalf.

When creating your POA, you’ll choose when your agent’s authority begins and ends, and what the agent has authority over. You can create a POA that delegates authority over your finances, your health care, or both. You can have a POA that becomes effective immediately, one that doesn’t take effect until you’re declared incapacitated, or one that’s only effective for a predetermined amount of time. It all depends on what’s best for your situation.

If you’re ready to create your POA, you can use an online service to generate the document for you. This way, you don’t have to worry about writing out the document yourself or paying expensive attorney’s fees. Once the document’s been created and executed according to your state’s requirements, keep it safe with your other important life planning documents.

Frequently asked questions

A power of attorney is a legal document, not a person, that grants power to an agent. The person being granted the powers of attorney is referred to as an agent or attorney-in-fact.

You can technically name anyone who is at least 18 years old and of sound mind as your agent, but a POA grants a lot of power to the agent, so make sure you choose someone who is responsible, organized, and trustworthy.

Using an online service, such as LegalZoom, to create a POA will cost $35–$45 depending on how complex the document needs to be.

The most expensive option is using an attorney, who may charge $300 or more to draft a POA. If you’re looking for the least expensive option, you can try to do it yourself. The only cost for this method may be getting the document notarized, but you may find this process difficult if you’re unfamiliar with these types of legal documents

A durable power of attorney will expire upon the principal’s death. A non-durable power of attorney will either expire after a certain period of time or when a certain event occurs, depending on how the document was drafted.

Regardless of the type of power of attorney you have, the agent’s authority will always end if you die. Continuing to act on behalf of the principal after they’ve died is illegal, which may result in criminal charges such as embezzlement, fraud, or theft.

The main advantage of a power of attorney: it will provide you with an organized plan to manage your affairs if you’re ever unable to make your own decisions. This is an important part of estate planning because you want to trust that your health care and financial decisions are managed in accordance with your preferences.

The disadvantage of a POA: you’re entrusting a lot of power over your affairs to someone else. This can lead to them taking advantage of this authority if you don’t choose the right person.5 Thankfully, there are safeguards you can include in your estate plan to limit any exploitation. You can also create a springing POA, so it doesn’t become effective until after you’ve been declared incompetent. This way you can continue managing your own affairs until you’re physically or mentally unable to do so.

Yes, your power of attorney must be in writing to be legally binding. Having a POA in writing makes it clear what the agent’s authority is—for example, whether they can make financial decisions, medical decisions, or a wide range of decisions on your behalf.

Although your POA won’t expire just because you moved out of state, we recommend you take this opportunity to update your entire estate plan. This will ensure your overall estate plan is tailored specifically to your new state’s laws.

Have questions about this review? Email us at reviewsteam@ncoa.org

Sources

- Consumer Financial Protection Bureau. What Is a Power of Attorney? Aug. 5, 2016. Found on the internet at https://www.consumerfinance.gov/ask-cfpb/what-is-a-power-of-attorney-poa-en-1149/

- Legal Information Institute of Cornell Law School. Definition of incapacity. June 2022. Found on the internet at https://www.law.cornell.edu/wex/incapacity

- Lori A. Stiegel, JD. Durable Power of Attorney Abuse: It’s a Crime Too. National Center on Elder Abuse. 2008. Found on the internet at https://ncea.acl.gov/NCEA/media/docs/Durable-PofA-Abuse-FactSheet-Criminal-Justice-Professionals.pd

- W. Birch Douglass III, et. al. 50 State (Plus D.C.) Survey of Powers of Attorney. American College of Trust and Estate Counsel. August 2019. Found on the internet at https://www.actec.org/assets/1/6/Douglass_Powers_of_Attorney_Survey.pdf?hssc=1

- Department of Justice Elder Justice Initiative. Identifying and Prosecuting Power of Attorney Abuse Nov. 18, 2021. Found on the internet at https://www.justice.gov/file/1453376/download