Key Takeaways

For some people who are still working and have employer-based health insurance coverage, it may make sense to delay enrolling in Medicare.

There can be penalties for delaying Medicare enrollment. Talk to your employer or a licensed Medicare adviser for advice on your situation.

Learn what factors you need to consider if you're still working when you become eligible for Medicare.

Medicare is a health and prescription drug insurance program for Americans age 65 or older and some younger people with disabilities. Although you pay into Medicare during your working years, most Medicare benefits are not free. You still may be responsible for paying premiums, copayments/coinsurance, and deductibles—also known as your “out-of-pocket” costs.

These out-of-pocket costs must be considered if you’re still working and deciding whether to enroll in Medicare once you qualify.

Is it a good idea to get Medicare if you're still working at age 65?

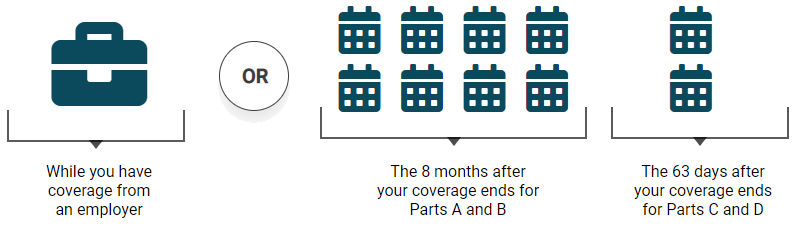

One important thing to understand about Medicare is that not everyone needs to enroll when they first become eligible. If you’re still working when you turn 65, it may be more beneficial to stay on your employer’s plan until you’re ready for retirement. There are Special Enrollment Periods (SEPs) that allow most actively employed people with employer healthcare coverage to delay enrollment in Parts A, B, C and D without facing penalties.

Some people continue with their employer health insurance and also enroll in Medicare, believing there will be fewer out-of-pocket expenses for care with two policies. But that’s not necessarily true.

There are two key considerations when deciding whether to enroll in Medicare when you're eligible—or to delay until retirement:

- If you or your spouse are still actively working for a company with at least 20 full-time employees, and that company provides health insurance and drug coverage, you may be eligible to delay enrollment in any of the parts of Medicare until you or your spouse retires (with a few exceptions).

- If your insurance is COBRA or TRICARE, or if you work for a company with fewer than 20 employees, you might consider Medicare when you are initially eligible at age 65.

When is My Special Enrollment Period?

Is it better to delay Medicare?

There are advantages to delaying enrollment in some or all of the parts of Medicare.:

- For most people (those with insurance through an employer with 20-plus employees), the employer's health insurance will probably be the primary payer, with Medicare being the secondary payer.

- As a secondary payer, Medicare will only pay a bill if the primary insurance (from the employer) pays less than what Medicare would have paid if it were primary.

- Employer health insurance typically covers more of the cost than Medicare, which results in Medicare not making a payment. This means youwon't save much money by having Medicare in addition to an employer’s plan.

Consider the following example

A doctor bills $437 for an outpatient office visit. But since the patient has a generous health insurance policy through their job, the visit is discounted to $250—and the plan pays 100% of it. In this example, the employer’s health insurance plan serves as the primary payer.

If Medicare was the primary form of health insurance, Medicare Part B would discount the visit to $200 (known as the Medicare assignment amount) but would only pay 80% of it. Therefore, Medicare would cover $160 of the visit (80% of $200), leaving a patient balance of $40 (known as the 20% coinsurance). With both forms of coverage, Medicare would pay nothing because the employer’s insurance plan (the primary payer) would have already paid the full $250.

This example shows it can be more cost-effective to keep employer health insurance rather than switching to Medicare when turning age 65, as the employer insurance will usually cover more costs than Medicare. This is why it may be unnecessary to have Medicare in addition to employer insurance.

Sometimes it's best to delay enrollment in Medicare until retirement. Depending on your situation, it may be beneficial to enroll in parts, but not all, of Medicare. Enrolling in Part A upon initial eligibility may make sense as it is premium-free for most people. However, given the monthly premium for Medicare Part B (in 2024, $174.40 or higher per month), enrolling in Part B right away may not be worth the extra cost if your employer insurance already covers more of the medical costs than Medicare.

Who can help me choose the right Medicare plan?

If you want to know, “How do I get unbiased Medicare advice?”, a great place to start is talking with a licensed Medicare adviser from an organization that meets NCOA’s strict Standards of Excellence.

At no cost to you, our partners will explain Medicare information in clear, easy-to-understand terms. You’ll receive impartial guidance, practical decision support, and trusted enrollment options—not a high-pressure sales pitch. Their goal is to help you find the right plan and feel confident in your decision.

Learn more about our broker partners and how they help older adults.

Note: This article provides general information only for your consideration. For assistance or questions about your specific situation, please contact you local State Health Insurance Assistance Program (SHIP), or contact your employer. Delaying enrollment in Medicare can result in lifelong penalties if certain conditions are not met. Please seek advice specific to your situation.